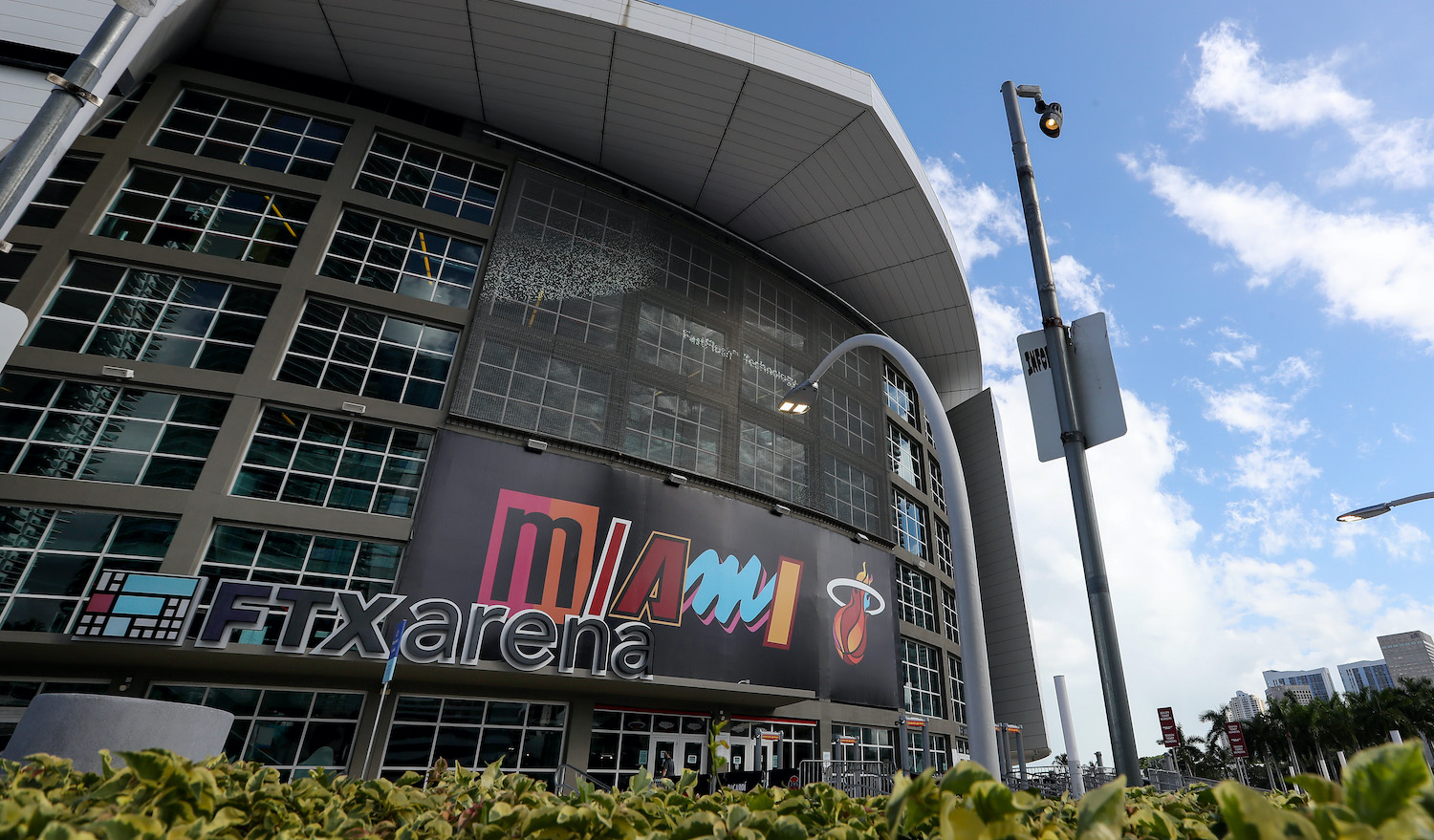

On Saturday night, the Miami Heat defeated the Charlotte Hornets, 132-115, winning what seems like it will be the final game played in FTX Arena. The Heat signed a 19-year, $135 million naming rights deal with the cryptocurrency exchange in April 2021, though as said cryptocurrency exchange is now bankrupt, the Heat and Miami-Dade County are yanking the ripcord as quickly as possible. "The reports about FTX and its affiliates are extremely disappointing," the team and county said in a joint statement. "Miami-Dade County and the Miami Heat are immediately taking action to terminate our business relationships with FTX. We will be working together to find a new naming rights partner for the arena." As always, the churn of corporate stadium nomenclature continues. Here is what that looks like in practice.

View from my condo in Miami, they seem to be dismantling the sign on the FTX Arena! pic.twitter.com/3gaHimxEwy

— Shiv (@shiv2268) November 11, 2022

Since we last checked in on Sam Bankman-Fried, his and his company's twin collapses have only accelerated. Per a report from CoinDesk, FTX was essentially run (into the ground) by a "cabal of roommates," a group of 10 people whose bona fides were mostly that they knew or had dated Sam Bankman-Fried. That group includes Caroline Ellison, the CEO of Bankman-Fried's crypto hedge fund Alameda Research, who, per the Wall Street Journal, oversaw Alameda during the tumultuous period when it bailed out Voyager in the wake of the Three Arrows Capital implosion. Alameda made a series of bad bets, which Bankman-Fried and FTX leadership attempted to cover by shifting $10 billion in customer funds from their exchange to their hedge fund. Between $1 billion and $2 billion of those funds are straight-up missing. Subsequent reporting into the relationship between FTX and VC firm Sequoia, recently seen marking its FTX investment down as a zero, showed that they passed the same hundreds of millions of dollars back and forth as they somehow invested in each other at the same time.

Alameda leadership also revealed that the firm has $1.5 billion in other debts, and even now that the company has declared Chapter 11 bankruptcy, their Bahamas-based assets have been frozen, and the U.S. government is going after them, this is crypto, so it's unclear if anyone will be made whole once the dust settles. Some money that people will definitely not see again is the $515 million siphoned out of FTX in what appears to have been a hack. News of the hack was announced by new FTX CEO John Jay Ray III, the former CEO of Enron.

Once it became clear that FTX was not going to have enough cash lying around to fulfill the remaining 17.5 years left of their arena deal, the Miami Heat dropped them, having already collected on a $14 million up-front payment. They are not the only sports organization distancing themselves from FTX. The Mercedes Formula One team signed a deal with FTX last year to put their logo on the car and, even more embarrassingly, launch a line of NFTs; they ended the partnership ahead of this weekend's Brazilian Grand Prix. Cal's football field and MLB umpires' uniforms are also sponsored by FTX, and one imagines that those associations are also in the process of ending. As part of their (now extremely funny) marketing push in early 2021, FTX courted a bunch of star athletes to serve as pitchmen for their Ponzi scheme, most notably Steph Curry and Tom Brady. I really like this quote from Brady, who was paid in now-worthless equity for the endorsement:

“It’s an incredibly exciting time in the crypto-world and Sam and the revolutionary FTX team continue to open my eyes to the endless possibilities. This particular opportunity showed us the importance of educating people about the power of crypto while simultaneously giving back to our communities and planet. We have the chance to create something really special here, and I can’t wait to see what we’re able to do together.”

MarketWatch

Thanks, Tom! FTX was one of the biggest institutional players in crypto, so obviously, its ignoble downfall will reverberate throughout the economy. If the second-largest exchange in the world, an exchange famous for casting itself as a backstop for the industry and saving ailing crypto companies, burnt all that money and died such a grim death, why would you believe that any of this is legitimate? Several exchanges have promised to be more transparent in the wake of FTX's collapse, a process that has, in one notable and sports-adjacent case, had the opposite result. Crypto.com attempted this past week to show proof of reserves (a figure that is not as immune to manipulation as it seems) and noticed that it recently bungled a $400 million transaction and sent it to the wrong wallet. It got the money back, though the fact that it were shifting around that much money in the first place raised some serious questions about whether it actually had sufficient reserves to cover everyone, and many customers are following the Binance guy's advice and moving their stuff off of Crypto.com.

Like FTX, Crypto.com bet big on sports sponsorships, buying the jersey patch on Sixers uniforms and agreeing to pay $700 million for 20 years of naming rights to the building formerly known as the Staples Center. When the crypto market started deflating earlier this year, I began emailing Anschutz Entertainment Group, owners of the arena, with a simple question: Have the scheduled payments from Crypto.com been coming through? They have not replied to any requests for comment. But surely a company whose reserves are 20 percent Shiba Inu coin won't have any liquidity problems in the future.

JUST IN: #CryptoCom CEO and founder @kris just released their "Proof of Reserve". The scary party... they hold more $SHIB than $ETH. pic.twitter.com/XmMOxFzkYR

— Mr. Whale 🐳 whalechart.org (@WhaleChart) November 11, 2022