The NBA struck a new TV deal Wednesday afternoon. Maybe Mark Cuban miscalculated when he chose to sell high, because it's as big as the optimists had been prophesying.

The league sold broadcast rights over an 11-year term to ESPN, NBC, and Amazon. ESPN, owned by Disney, will pay $2.6 billion per year for 80 regular-season games, 18 early-round playoff games, the Finals, and one of the Conference Finals; NBC, owned by Comcast, will pay $2.5 billion per year for Monday nights on Peacock, "up to 100" regular-season games, All-Star weekend, and 26 early-round games; Amazon will pay $1.93 billion per year to stream 66 regular-season games, the In-Season Tournament, the Play-In Tournament, and "approximately one-third" of the early-round playoff games. NBC and Amazon will cover the other Conference Finals in alternating years, and International rights distribution will be split between all three. That's a total of $77 billion. The deal kicks in ahead of the 2025-26 season. Warner Bros. Discovery, which has broadcast the NBA on TNT on-and-off (mostly on) since the cable era, will no longer carry the league for the first time in decades after the NBA rebuffed its attempt to match Amazon's offer. ESPN stays in a business it reentered alongside TNT in 2002, NBC makes its return after broadcasting the league's 1990s era of explosive growth, and Amazon gets into the business for the first time.

The heft of this deal, the ongoing fight between Amazon and Warner Bros. Discovery, and the motivations behind Comcast getting back in the business comprise a definitive statement about the future of live sports, as well as illuminate the way the NBA conceives of itself. Which is to say, referring to it as a deal to broadcast TV rights feels a bit anachronistic. Consider the NBA's own rhetoric:

"Our new global media agreements with Disney, NBCUniversal and Amazon will maximize the reach and accessibility of NBA games for fans in the United States and around the world,” said NBA Commissioner Adam Silver. “These partners will distribute our content across a wide range of platforms and help transform the fan experience over the next decade."

NBA

The key word there is "accessibility," which may as well have been followed by "on TikTok." The move away from live TV is continuing to speed up, even if the NBA hedged a bit by being enamored of airing games on NBC proper. Amazon does not have the on-TV reach of TNT, which is insignificant next to their globe-bestriding presence, in particular on the internet and in streaming. The deal is worth three times as much as the nine-year deal that ends after this forthcoming season, and extends for two years longer. That shows how seriously anyone should have taken previous grumbling about TV ratings, and how optimistic the companies that have surfed the streaming wave are about the NBA's future alongside them in the barrel.

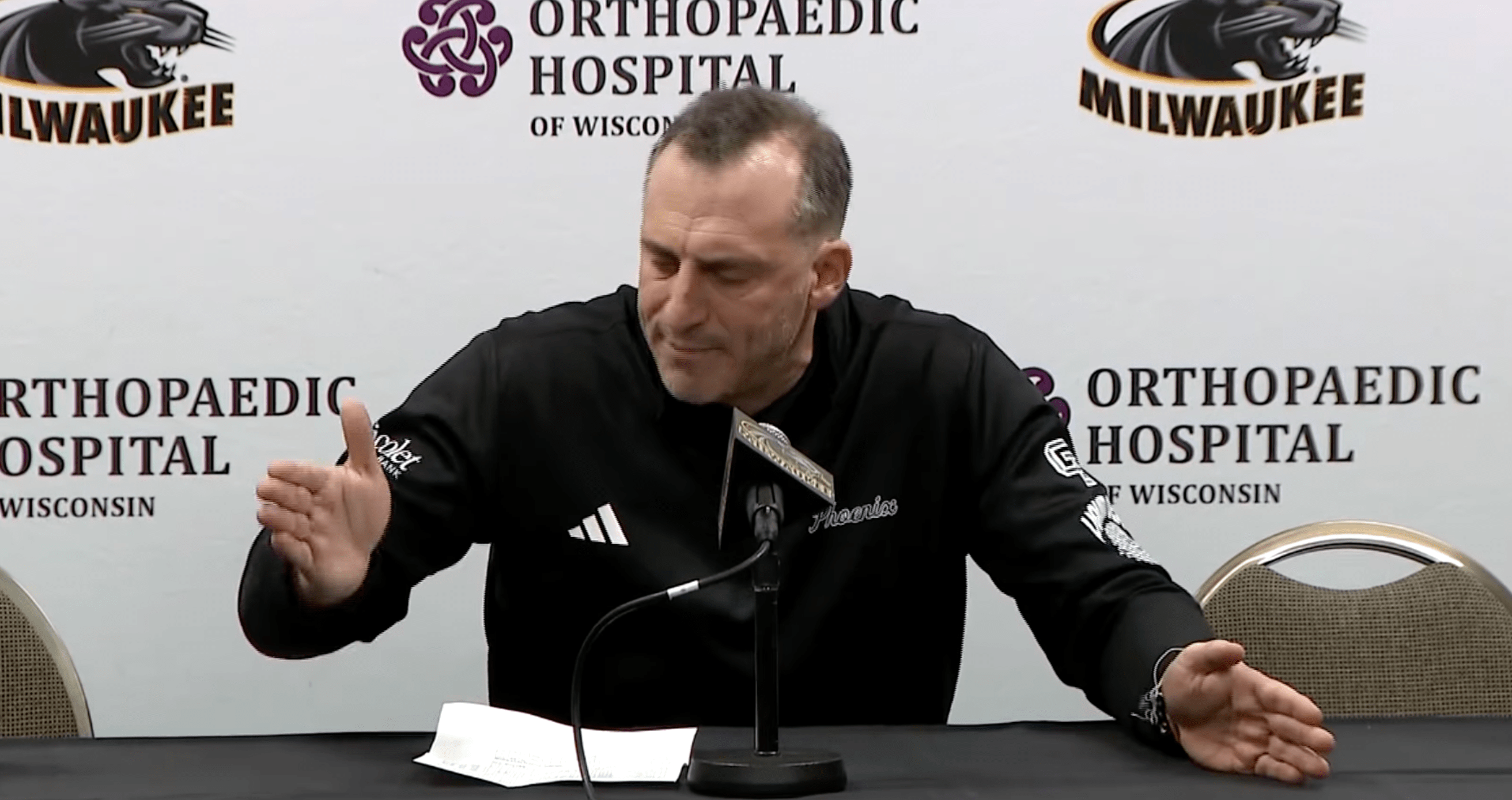

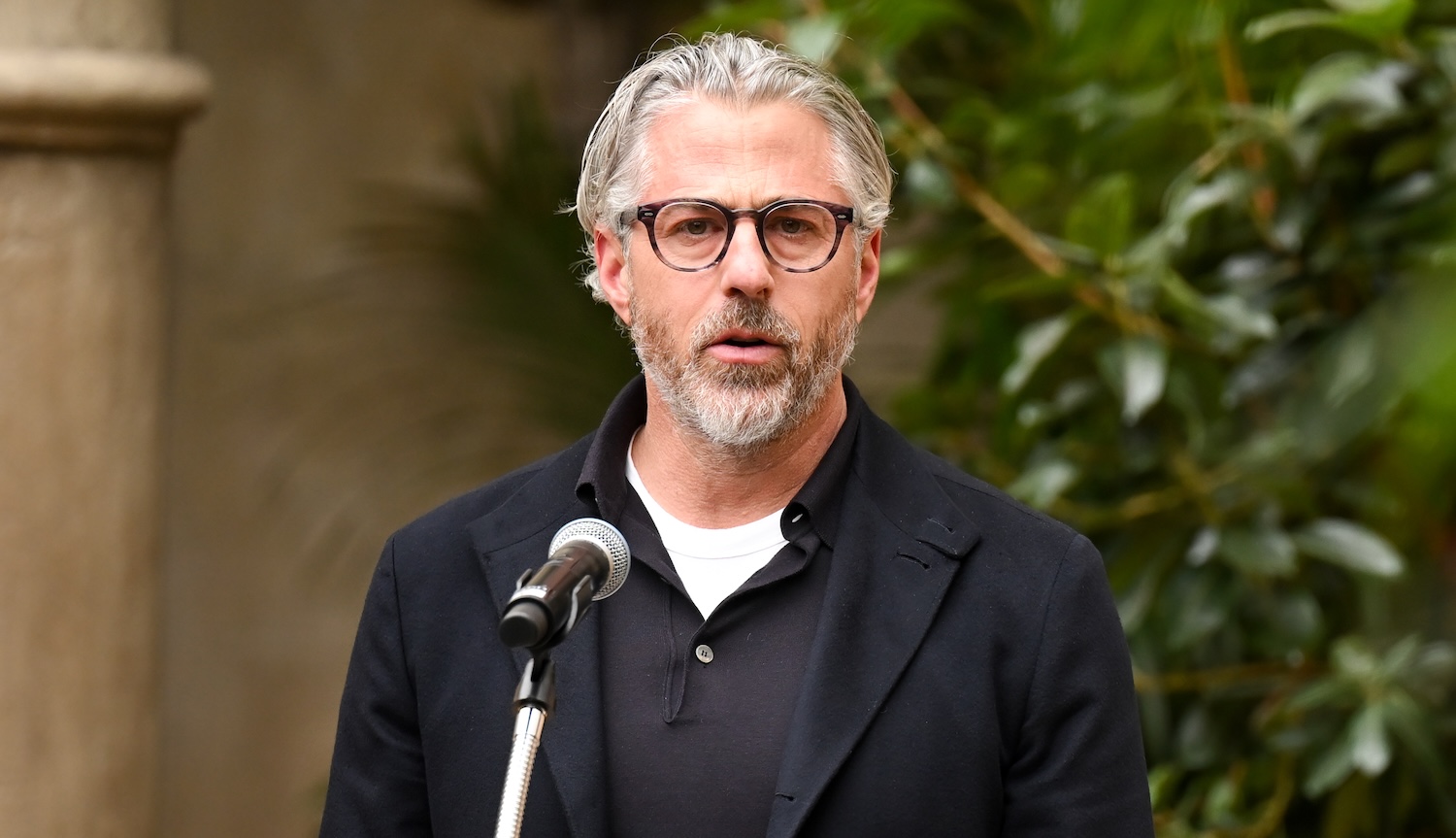

ESPN chairman Jimmy Pitaro, whose parent company has a significant deal with YouTube TV, said his network and the NBA "will continue to evolve together while successfully navigating the global digital transition." Comcast president Mike Cavanagh, who oversees a company that slipped to being the second-largest TV provider in the country behind Spectrum after losing more than 2 million cable subscribers in 2023, and Prime Video lead Mike Hopkins, whose company has a higher market cap than Saudi Aramco, promised to "innovate and evolve live sports coverage for our customers" and bring them what he called, uncannily, an "incredible video experience." TNT's lawyers said, more or less, prepare to fight.

Warner Bros. Discovery CEO David Zaslav, a man who has never met a dumpster he won't dive into, has claimed for months that the current contract states he has the right to match any offer Amazon makes. The NBA rejected WBD's matching bid, saying it "did not match the terms of Amazon Prime Video's offer," and repeating the bit about maximizing reach and accessibility. TNT's statement, published shortly after the NBA announced the deal, was a threat, asserting their right for the offer to have been accepted. "We have matched the Amazon offer, as we have a contractual right to do, and do not believe the NBA can reject it," they said. "We think they have grossly misinterpreted our contractual rights with respect to the 2025-26 season and beyond, and we will take appropriate action."

How could the contract language be uncertain enough for the NBA to feel confident rejecting the offer? Per The Athletic, TNT has "honed its sights on Amazon’s streaming-only agreement," which seems to hint that the language around "streaming" was somewhat uncertain.

What is as interesting to me as the the move towards streaming is the size of the deal framed against years of grousing about TV ratings. Months ago, the pessimists' case would have gone something like: Streaming is still incompatible with live broadcasts, and cord-cutting is as much about moving away from watching things live as it is correcting an imbalance. Therefore, the NBA is still tied to the descending anchor of cable TV, and its ratings spell doom. Alternately, TV ratings show the league is culturally irrelevant, or, if you are stupid, it has something to do with wokeness.

I was never very convinced by ratings chatter, because even if one accepts that ratings matter, it can't be argued that they are the only, or even operative, factor to consider when evaluating the health of the league. The league would not have just tripled the value of its broadcast deal if they were. Perhaps this line of thinking overweighs the importance of a dying medium, especially as the league positions itself to move to streaming to a more dramatic degree than the NFL (whose adherence to the paradigm of broadcast television is such that they strictly enforce the "express written consent" part of the disclaimer). The advertising-based loop of putting a thing on TV and selling ads against it doesn't work, but growing the overall reach of the product does. There is no way to point this out without feeling old, but the NBA Instagram account has nearly three times as many followers as the NFL account. Clearly, something is working well enough for Zaslav to threaten a lawsuit over not getting the rights.

I can't imagine either side wants to open themselves up to discovery, so the most logical outcome might involve TNT getting some sort of settlement. That means the unfortunate end of Inside The NBA as it currently exists, and hopefully the merciful end of Draymond Green's TV career. That's a TV decline I hope we can all support.