Defector Annual Report, September 2021 – August 2022

Published on October 27, 2022

Purpose of this report

Defector continues to have no outside investors and no intention of raising outside capital. We therefore have no obligation, by law or convention, to write an annual report about our business operations. With all that said, our subscribers and other interested parties found our first annual report in October 2021 to be compelling enough, and given that our business has meaningfully progressed over the past 12 months, we believe it a worthwhile endeavor to write and publish this second annual report.

Financial summary*

| 9/20-8/21 | 9/21-8/22 | |

| Total subscription revenue | $3,000,000 | $3,600,000 |

| All other revenue combined (merch, site sponsorships, podcast advertising, streaming) | $200,000 | $200,000 |

| Total revenue | ~$3,200,000 | ~$3,800,000 |

| Employee compensation | $1,700,000 | $2,000,000 |

| Employee benefits | $150,000 | $200,000 |

| Alley Lede fees | $250,000 | $300,000 |

| Other tech, processing, and platform fees (Pico, Stripe, Mailchimp, Getty, etc.) | $300,000 | $400,000 |

| Professional fees (legal, HR, accounting) and insurance costs | $200,000 | $175,000 |

| Merch production & fulfillment fees (including promotional giveaways without direct revenue) | $50,000 | $60,000 |

| Freelance spend and reporting expenses | $100,000 | $175,000 |

| Paid advertising | $30,000 | $5,000 |

| Rent | N/A | $30,000 |

| Taxes, state and federal filings, and related processing fees | $200,000 | $250,000 |

| Other General & Administrative expenses | $50,000 | $80,000 |

| Total operating expenses | ~$3,000,000 | ~$3,700,000 |

Revenue details

We continue to rely overwhelmingly on our subscribers’ direct subscription dollars to fund editorial and business operations. Of the $3.8mm revenue Defector recognized this year, 95% was generated by subscriptions to the website.

The gross number of people who have ever held a paid subscription to Defector.com is 49k. Net of churned subscribers (i.e., people who once held a paid subscription, but no longer do), we reached a high-water mark of 40.2k+ net active subscribers in early September 2022. As of September 30, 2022—the three weeks before which a majority of annual subscribers faced a renewal opportunity—we had 38k active subscribers.

Approximately 62% of subscribers are Readers, our base tier, 32% are Pals, the next tier up, and 5% are subscribed via our Normal Gossip podcast products (Friend and Friend-of-a-Friend). We currently have about 70 subscribers at the $1,000/year Accomplice level. More than 80% of our subscribers are on annual plans rather than monthly ones. Over the full period of Year 2 (September 2021-August 2022), the rate of retention for annual subscribers averaged out to 87%, with earlier subscriber cohorts generally retaining at a higher level than later ones and Pals generally retaining better than Readers. During the month of September 2022, our second renewal subscribers—i.e., those who subscribed in 2020 and are entering their third year subscribing to Defector—are renewing at a rate of ~90%, with that number continuing to tick up slightly as credit card failures are resolved. For those on monthly subscriptions, our average churn rate from September 2021-August 2022 was ~3% per month, though that number varied meaningfully by cohort.

Growth in our subscriber base came from different sources and initiatives in Year 2:

- We offered promotional pricing for the first time, a deal that charged $0.99 for the first month before converting renewing subscribers to regular Reader pricing. We launched the promotion on Cyber Monday 2021 and ran it through early 2022. Nearly 2,000 people total subscribed through the promotion, and over 60% of them converted to full-price subscriptions after their promotional month was over. The promotion served as the default subscription offering via pop-ups on our website, and we further pushed the campaign through occasional tweets and a handful of emails to our non-paying mailing list of ~150,000 email addresses. (Our most successful email, one from Tom Ley with the subject line “I see what you’re up to” and preview text of “This whole time you’ve been waiting for a deal,” generated ~1.5x the normal open rate and ~2x the normal clickthrough rate of our subscription appeal emails, but it also resulted in several complaints that the subject line was alarming and creepy. Despite that email’s effectiveness, we have since tried to stay away from creepy subject lines.)

- With the popularity of the Normal Gossip podcast (more on our podcasting efforts below), we developed new subscription products aimed at Normal Gossip listeners. The $5/month Friend-of-a-Friend product includes an exclusive subscriber episode plus a limited number of Defector blogs each month. The $12/month Friend product also includes the chance to be the guest on those exclusive subscriber episodes, access to the Normal Gossip “Close Friends” stories on Instagram, and full access to Defector blogs. We launched the subscription products to coincide with the premiere of Season 2 and have seen excellent uptake so far, with ~2,500 gross paid Gossip subscribers and monthly retention rates largely in-line with our standard Defector subscribers. We have heard from podcast experts that Patreon-supported podcasts can expect to eventually convert 1-4% of regular listeners to paid subscribers; the average Normal Gossip episode so far has received 250,000 streams, so our conversion rate to date has been in-line with benchmarks and may have further upside to go.

- We ran back the holiday subscription gifting campaign in 2021 with branded beanies instead of the tote bags of 2020 offered to gifters. We sold ~300 gifted subscriptions in 2021, a good number but meaningfully lower than the ~600 sold in 2020. Given the diminishing returns of the merch-supported gifting campaign, we may rethink that approach this holiday season, or perhaps not really put effort into one this year.

- We paused all of our paid digital advertising efforts. In last year’s report, we shared that our experiments with Twitter advertising were unpleasant; that our early returns with Google advertising were promising; and that we refuse to spend any money with Facebook. We decided to stop spending what little budget we had previously allocated to digital advertising, as we realized we did not have the expertise nor the bandwidth each week to really learn from and optimize our campaigns. As we work our way through other priorities, we intend to resume experimenting with paid advertising to understand which levers would actually be effective and worthwhile investments. Many thanks to Andre Sternberg, a Defector subscriber and digital advertising expert, for his pro bono advice to our team.

- To grow the “top of the funnel” and increase overall awareness of Defector Media, we made an effort to more systematically reach out to publications, podcasts, radio shows, and TV programs when we published stories that might be relevant for their audiences. It’s hard to measure the impact of such efforts—the vast majority of outreach goes unacknowledged, and arguably the broadest coverage of a Defector blog in the past year (Dave McKenna’s reporting from Death of a Snake Salesman was heavily cited when CBS News dedicated a full episode of 48 Hours to the story) came about through no proactive outreach on Defector’s part - but we will continue to dedicate some time and energy to this sort of work. Many thanks to Ed Zitron, a Defector reader, PR professional, and Twitter Person, for his pro bono advice to our team.

Good blogs continue to be our best marketing tool. Timely, well-written posts tend to get shared on social media. In turn, this allows new people to discover Defector, read a couple of blogs, encounter the registration wall, and enter the top of our conversion funnel. Good blogs are good for business, whether that’s keeping current subscribers happy or attracting new readers.

Newfound access to more granular user-level engagement data allows us to sharpen that last statement a bit. In Year 2, the correlation between the count of logged-in users who read a given blog and the count of new users who registered on that blog is ~0.6. In other words, the blogs which do well with our existing subscribers also tend to do well in terms of attracting new users.

Our other major revenue streams include podcast ad sales, merch sales, some live event ticketing, and monetization of our Twitch, Amp, and YouTube channels.

Defector now has three podcasts: The Distraction, Namedropping, and Normal Gossip. Production and ad sales for The Distraction continue to be managed by Stitcher/SiriusXM. Namedropping and Normal Gossip are produced in-house, with ad sales handled by Audioboom.

Our process for producing the two new podcasts was methodical and relatively slow-moving. In late 2020, we agreed to set aside some budget for a podcast pilot process and established three goals for doing podcasts: (1) reach new audiences, (2) give staffers an opportunity to work within a new medium, and (3) diversify our revenue somewhat. Staffers pitched podcast concepts, and in January 2021, they created pilot episodes for five different podcasts under the guidance and partnership of freelance audio producers Caitlin Pierce and Harry Krinsky. We sent those pilot episodes to our subscribers and surveyed them for feedback in February 2021, then tried to take those episodes and the subscriber feedback to various podcast production companies in the spring. We hoped to find a partner excited by at least one of our podcast ideas who would be willing to handle the various production, distribution, and eventually ad sales responsibilities, so we wouldn’t have to figure out how to do any of that ourselves.

After a round of meetings, we received no real interest except from Audioboom, where their VP of Content Partnerships, Erik Heiss, was very familiar with Defector and in fact had emailed us the prior year asking if we wanted to make any more podcasts. Audioboom was unable to provide production support but was happy to let us drive 100% of the content decisions, including which concepts, with what release dates, and at what release cadence. With our agreement with Audioboom in place, we began working with audio producer Alex Sujong Laughlin, and under the guidance of Projects Editor Justin Ellis, we decided to produce an initial run of two podcasts, Namedropping and Normal Gossip. Both shows premiered the first week of January 2022.

Normal Gossip took off more or less immediately. The New Yorker blurbed the show after two episodes; total streams surpassed one million in April; for Season 2, Audioboom started selling host-read ads, which began to generate meaningful direct revenue (Season 1 was lightly monetized through dynamic insertion of Audioboom’s inventory of “general run” ads); as mentioned above, the Normal Gossip subscription products are selling well; and the first live show, held at Caveat in NYC on June 1, sold out in 48 hours. The listenership is two-thirds female, 50% under age 35, and 20% international, with a particular stronghold in Australia.

We will be producing a second season of Namedropping and do intend to create more podcasts in the future, though with our small team we’ll continue to be careful that commitments to new projects do not degrade our core product of good blogging. To that point, we are currently in the process of evaluating potential podcast partners in hopes of streamlining our audio projects going forward, and we’re glad to have new podcast agents at UTA to help us sort through possible options.

Our merch shop continues to be run through Fii Marketing, a unionized merch maker based out of Rhode Island. Dan McQuade leads the Defector-side merch operations and design and this past year oversaw a redesign of the storefront and expansion of our product lines, including a line of Normal Gossip merch. We better aligned our merch drops with the sports and holiday calendars, and we were able to capitalize on breaking news where possible (our Quit Like a Champion shirts sold briskly after Brian Kelly quit as head coach at Notre Dame). Our margins continue to be relatively tight, but merch out in the world doubles as an excellent, cheap marketing channel to spread the Defector brand, and we’re proud to be associated with Fii’s U.S.-based and union-made production.

We continue to do regular shows on Twitch for live video programming and Amp for live audio programming, with an increasing focus on repurposing that content and publishing to YouTube as well. Luis Paez-Pumar persists as our creative director, producer, and primary antagonist to chat across these channels.

We have largely stopped doing on-site and newsletter sponsorships. Last year, we shared that we would increasingly be focused on smaller, direct-to-consumer brands, but marketing budgets have tightened and sales cycles have been long. We are picky about what brands we work with, and since our sponsorship sales have been so inconsistent, each time we do have a new sponsor we field some number of complaints from readers who hadn’t been accustomed to seeing sponsorships on the site. As currently constituted, our operations team is inexperienced and/or bad at sales. We will very much still consider inbound requests from brands, and in the future, we might choose to make a real investment in managing a repeatable sales process, but operating with a small team is all about managing trade-offs. At the moment we don’t believe focusing on selling sponsorships is the most effective use of our limited resources.

Employee compensation & benefits details

In Year 2, with revenues growing and with more data and faith in the stability of the business model, we were able to pay ourselves more. We also had to spend more money on health insurance.

As mentioned in last year’s report, many of our group health insurance plans purchased through our Professional Employer Organization, Trinet, increased by double-digit percentage points in 2021-2022, including one by 40%. With concerns that our Year 3 renewal would result in even more severe price increases, we requested proposals from other PEOs and ultimately decided to move to Insperity. Our staffers are now on either group insurance plans through Insperity or HRA-supported plans purchased from their state health insurance exchanges, which in aggregate should result in a more modest (but still significant) increase in total healthcare costs to the company in Year 3. Once again, navigating the U.S. health insurance procurement process has sucked shit.

Tech details

In Year 2, our Alley Lede costs increased in line with subscription revenue growth, as expected, since our platform agreement pays them a percentage of our recognized subscription revenue. Our Pico and Stripe fees also increased in proportion to gross subscription cashflow, but our spending on other tech increased faster than our revenue growth. These increases represented brand-new software implemented in Year 2 (e.g., various podcasting needs), a full-year cost load of existing software that we implemented midway through Year 1 (e.g., Lattice for goal-setting and professional development, DeleteMe for identity information protection), and significant cost increases in existing software and platforms (Getty Images, Mailchimp).

We continue to have no dedicated product or engineering talent on staff at Defector and rely on Alley Lede as our main technology partner.

Additional operating expense details

Our total spending on professional services went down over the last year as we moved past the various upfront startup legal and HR fees. Our stable of professional service partners has stayed steady, and we continue to work closely with Alan Lungen (outside general counsel), Rachel Strom and Jeremy Chase of Davis Wright Tremaine (free speech rights), Black Ink Services (bookkeeping and controller services), Romano & Associates (accounting), and Your Other Half (outside HR). The premiums for our company liability insurance policies increased in aggregate by about one-third from Year 1 to Year 2 but are expected to increase at more modest rates in Year 3.

We continue to rent a small office in a coworking space in Downtown Brooklyn for our New York team. We are still on a month-to-month contract, such that we could shed this expense relatively quickly if we found ourselves in a cash crunch.

We meaningfully increased our reporting and freelance spend this past year. We were able to send writers to do on-the-ground reporting at NFL training camps, an F1 race, and a weird LIV golf event in New Jersey; expand our subscriptions to reporting databases and publications; and pay (sometimes obscene) fees for FOIA requests.

In early 2022, we partnered with the National Writer Union’s Freelance Solidarity Project to update our freelancer policies. In the past year, we commissioned freelance pieces from over 50 writers and also worked with a dozen freelance artists, designers, translators, and producers. Below are some particularly excellent freelance blogs from the past year that generated an outsized number of pageviews or new registrations:

- The Limits of Dave Chappelle and Kyrie Irving’s Free Thinking by Jason England

- How I Got Smart by Amy Schneider

- The Mostly Untold Story Of How The Sports Bra Conquered The World And Tore Its Inventors Apart by David Davis

- Don King Comes Home by Vince Guerrieri

- A Widow Starts Living In Her Van by Lori Teresa Yearwood, part of the recurring series “How Are You Coping With That?” supported by The Economic Hardship Reporting Project

- How The Internet Works by Kat Brewster

- The Secret History of The Internet’s Funniest Buzzer-Beater by Brian Feldman1

- What The Hell Happened To The LA Marathon? by Adam Conover

- A Middle-Aged Person Takes Up A Hobby by Felix Kent

About our community of subscribers

We did not run a subscriber survey this past year, which was a major oversight and one we hope to rectify soon with more regular survey touchpoints with subsets of subscribers.

Though we do not have new self-reported subscriber data, we were recently able to analyze larger swaths of site engagement data. Here are some interesting findings:

How engaged are Defector subscribers?

In short, Defector subscribers are highly engaged with the site. Anecdotally, it felt like this had to be true, and it’s nice to have corroborating data.

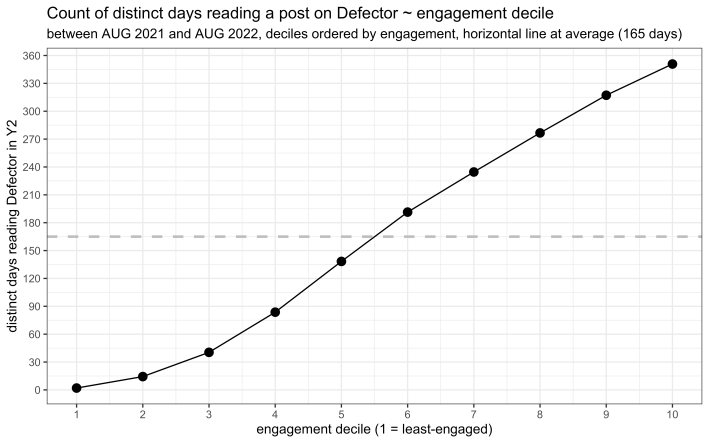

Below, we sorted our subscribers2 into deciles ordered by the count of days between August 2021 and August 2022 on which they read at least one post3 on our site. Decile 1 represents the least-active 10% of our subscribers, and Decile 10 represents the most-active 10% of our subscribers. The plot shows the average count of days with engagement by decile.

- Our average subscriber reads Defector on 165 of 365 days in Year 2 (or more than 3 days per week) and reads more than 10 posts per week.

- On average, our most-active 50% of subscribers read ~1,000 posts over 275 active days in Year 2. Kudos to the 70 subscribers who read the site on 365/365 days; no kudos to the 81 subscribers who read on only 364/365 days.

Does engaging with Defector reduce churn?

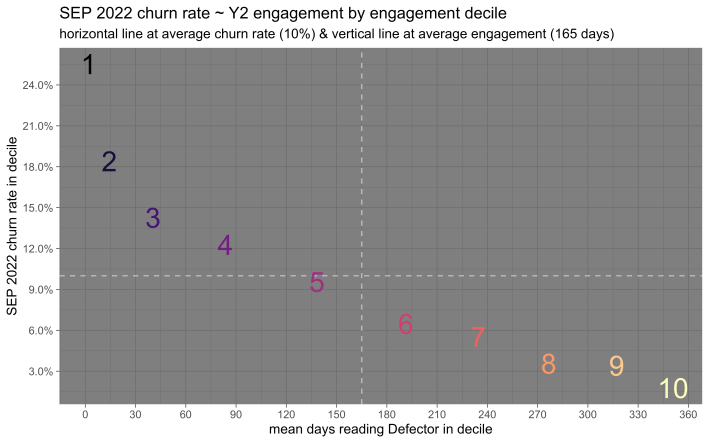

Try as we sometimes might to effect the opposite, subscribers who read Defector more tend to churn at a lower rate.4

Recall from the revenue details section that 10% of our subscribers who faced a renewal decision in September 2022 churned. When we plot churn rates by engagement decile, the plot below looks like what one would intuitively expect: Our least-engaged users churn at the highest rate, and our most-engaged users churn at the lowest rate.

What can we learn from subscribers who churned?

During the summer of 2022, we emailed a short survey to all ex-subscribers of Defector asking why they canceled their subscription. Nearly all of this feedback was constructive and useful, especially this from our own Ray Ratto:

I WORK AT DEFECTOR! I OWN A PART OF DEFECTOR! I DON’T HAVE TO SUBSCRIBE! I SHOULD BE GETTING IT FOR FREE AS A CONDITION OF MY EMPLOYMENT! WHY AM I BEING ASKED THESE QUESTIONS?

In summary, we found that:

- More than 40% of respondents cited financial hardship as a primary cause of their churn.

- More than 60% felt they weren’t reading enough to justify the subscription cost.

- ~10% named each of the following as a primary cause of churn5:

- seasonality in the sports calendar (e.g., football-only readers);

- article quantity;

- article quality;

- website product experience issues.

We often joke about our commentariat being all well-paid lawyers, but the fact that nearly half of churned subscribers were experiencing financial hardship served as a good reminder that our readership is not a monolith. (It also partially informed our decision to not increase prices going into Year 3. More on that below.)

A final takeaway from this survey is that more than 80% of these survey respondents indicated some willingness-to-pay for a Defector subscription in the future,6 and this finding has informed our Year 3 roadmap in that we hope to “win back” some share of our ex-subscribers.

Outlook for Year 3

One might summarize Defector’s primary Year 3 goals as simply as:

- Making enough money to keep making Defector what we want it to be; and

- Reaching more people with our work.

On the former count, we do not expect to grow subscription revenue by double-digits again this year. Under any conditions, each additional subscriber is more difficult to acquire and retain than the last. While we believe our subscriber base is small and loyal enough for us to mostly avoid broader “subscription fatigue” trends, the worsening macroeconomic environment will surely hamper acquisition and retention efforts. We are developing budgets while assuming subscription revenue growth of single digits or worse.

We have also intentionally foregone the biggest lever available to us—increasing prices prior to the 20,000+ annual renewal decisions our subscribers made in September 2022.

We seriously considered raising prices7 but ultimately decided it was not yet appropriate to do so. We believed that we could make up most of the foregone subscription revenue through a combination of other initiatives; the trajectory of Normal Gossip provided a meaningfully larger cushion of non-subscription revenue; and “some of our costs are going up, and other media products are raising their prices, too” were not good enough reasons to pass on costs to subscribers.

Perhaps most importantly, 24 months into our website’s existence seemed too soon to be taking actions that would likely reduce our reach and increase the insularity of our readership. The overall increase in revenue was not worth losing the subscribers—especially those for whom the additional $1-2/month or $10-20/year really matters—we would cause to churn (or never subscribe in the first place).

This decision should not be read as us going George H. W. Bush Mode about any future price increase. We might need (or otherwise want) to raise prices at some point in the future. We will aim to do so only when the subscription product is meaningfully stronger than what our readers paid for in previous years, and/or we have a specific investment (or, heaven forbid, some hole) in the budget we need to direct funding towards.

So, instead of pulling the large price increase lever, we plan to execute on a bunch of smaller projects. Examples include redoubled acquisition efforts (including paid advertising) that relies on better segmentation of our non-paying readership, a campaign to win back previously churned subscribers, and systematic efforts to push the Tip Jar we use to fund our Pay-Forward-a-Subscription fund.

On the last count, you may have heard about the Roth Cutout Sweepstakes. (If you haven’t, the campaign runs through Halloween, so you still have time to enter the drawing.)

The campaign is an elegant solution which squares a bunch of competing interests: First, it allows us to capture some of the consumer surplus (i.e., the “slack” between what subscribers are paying and what they are latently willing to pay) we left on the table by not increasing prices on everyone. Second, it does so without causing incremental churn among subscribers unable or unwilling to bear a price increase. Analytically, this achieves something approximating price-floored Pay What You Want pricing. Then, because contributed funds are earmarked for our Pay-Forward-a-Subscription fund, they have underwritten some amount of the growth into new audiences we want to achieve in Year 3. Finally, the residents of the apartments directly across the street from our Brooklyn office have not enjoyed the Roth cutout leering into their windows, so we need to send it to a new home.

The campaign has been live for about a month now, and so far we’re thrilled: As of this writing, we’re up over $50k in contributions from ~1.3k subscribers. We have cleared more than half of the expected value of the price increase scenario we considered most closely this summer. We will, of course, need to pay for the Roths’ transit, and we owe everyone some high-quality video content from their journey, whether that’s via a flight to Alaska or a crosstown bus.

Perhaps less glamorously—but no less importantly—we also have some important and long-awaited technical improvements coming soon. We expect to move onto the next-generation of the Alley Lede platform in early 2023. We eagerly await the migration which should put us on the path to an improved reader experience, a more flexible back-end CMS, and an integrated data warehouse. In the longer run, access to near-live data will allow us to test, learn, and iterate on questions large (what should our new-subscriber onboarding campaign look like?) and small (what happens to engagement when we post blogs at 7:30 p.m. on a Friday?).

Outlook for Year 3 for all the other stuff that’s not subscription revenue

The major driver of growth in non-subscription revenue will be Normal Gossip, which will generate a six-figure year-over-year increase in podcast advertising dollars. We expect all other categories of non-subscription revenue to hold relatively steady, in the range of -5% to 5% YoY change. (Translation: We do not really know how to forecast those categories, so everyone will just keep doing what they’re doing.)

On the cost side of the P&L we expect, similar to any number of other businesses, to face inflation-driven increases to many expense items. One development in our favor, however, is a reduction in revenue-sharing fees related to our website tech stack that came into effect in Summer 2022 and will become more apparent in our full-year financials in Year 3. We’ll be making a concerted effort to reduce fees and optimize nuts-and-bolts business processes (e.g., cash management tools, credit card portfolio) that should squeeze out additional tens of basis points of profit over the course of the year.

Editorially, we hope to make incremental investments of money and effort in as many areas as possible. We are beginning production on the second season of the Namedropping podcast shortly, and we intend to try some new podcast concepts, potentially with early test runs on Twitch or Amp. We hope to fill our open staff writer role. We hired a terrific summer intern in 2022, and we want to maintain an internship program going forward. We will focus more on the art design and visual identity of the website, with Dan McQuade leading the charge as Visual Editor. We’ll try to create a bit more prerecorded video content and host a few more live events, not as any existential pivot, but because they’re fun and provide opportunities for our staff to develop their skills in new mediums.

Finally, an important Defector Media company goal in Year 3 is for a majority of the staff to meet Ray Ratto in-person. We have planned three company-wide gatherings on the East coast in the last 14 months, and unfortunately Ray was not able to attend any of them. A handful of us have passed through the Bay Area and dined with him (which inevitably involves a well-wisher approaching the table to chat and ask if Patrick Redford is Ray’s son), and in 2023 many more of us must experience that privilege, even if we have to hold the next company retreat in Ray’s backyard.

Your input

We are another year older and wiser in building and sustaining the Defector project, and while we’re just as proud as ever of the business we’ve built and the community that’s developed around it, we largely still consider ourselves Big Dumb Idiots Who Don’t Know What They’re Doing. A real benefit of publishing last year’s Annual Report was receiving input from subscribers and well-wishers with real expertise, so this year we again would welcome any thoughtful constructive feedback or advice you might want to offer. Feel free to email jasper@defector.com, sean@defector.com, tom@defector.com, or your favorite Defector writer with the subject line “You fool, you absolute buffoon.”

Thank you for your continued support of Defector. See you tomorrow.

Footnotes

- From that blog's Editor's Note: On Oct. 19, 2022 Defector published a followup to this article, revealing that the recollections of several of our sources were incomplete or based on false memories. The true story of who got nailed by that basketball is more complicated, and even more interesting, than what’s written here. We apologize for the error. We still suggest you read this article first, then the sequel.

- We do not have “live” access to engagement data, so this analysis focuses only on the ~26k subscribers who: (a) were subscribed as of the end of August 2021; (b) were also subscribed as of the end of August 2022; and (c) faced a renewal decision in September 2022.

- From prior experience and outside expertise, the best single predictor of an individual subscriber’s propensity to churn from a subscription is the count of days in the term before the subscriber’s renewal decision on which they read a post. Knowing the depth of that engagement adds information – someone who reads two posts per day on 100 days per year is stickier than someone who reads one post per day on 100 days per year – but frequency-only metrics get most of the way there.

- There are subtle-but-important questions about correlation and causation here, so we will appropriately stop short of making hard claims about the marginal churn-prevention effects of reading Defector. We regard the observational relationship between retention and engagement as an upper bound on the churn-prevention effects we might expect out of some product or editorial effort which boosts engagement.

- Note that respondents were allowed to select multiple reasons for canceling, which is why the percentages sum to more than 100%.

- As with all survey data, it’s important to think about the direction and magnitude of response bias. In our case, it’s likely that people with nonzero willingness-to-pay are overrepresented in the respondent sample relative to the underlying population of churned subscribers. In parallel, our 'primary cancellation reason' data is also surely impacted by this response bias.

- Here’s a little more analytical detail on our process of deciding whether to raise prices, in case any peer organizations want to compare notes or any readers are particularly interested in our thought process for balancing short-term revenue growth vs. other considerations.Something like three-quarters of our existing subscribers faced a renewal decision in September 2022. A price increase would have been the most-efficient – biggest bang for least effort – revenue lever available as we entered Year 3. The effectiveness of raising prices will vary by industry, the degree of product differentiation within your industry, and the relative sizes of your existing subscriber base and future expected growth. In a vacuum, raising prices on existing subscribers to a differentiated product should generally increase revenue. (There is a reason that other subscription businesses and media companies did so this year.) “Elasticity” is a helpful shorthand for understanding the relationship between a change in price and a change in quantity. An elasticity of -0.5 implies that a 10% increase in price will cause a 5% decrease in quantity sold. Demand is “inelastic” in these cases, where price effects dominate quantity effects. When a business faces inelastic demand, increasing prices will tend to increase revenue. Given an elasticity assumption, it is straightforward to calculate counterfactual expected revenues as a function of a price increase. Much less straightforward is knowing what a good elasticity assumption is. Ideally, one would have amassed a bunch of experimental data – randomly assigning prices to visitors and subscribers, and measuring whether or not they subscribe and retain – but that hasn’t been feasible for us. Instead, we drew on our experience working on subscription and subscription-adjacent businesses and modeled scenarios for a conservative range of elasticities (between -0.15 and -0.60).To evaluate prospective price change scenarios, we adapted our financial model to accept sets of subscription price & elasticity assumptions and produce updated estimates of net active subscribers & revenue. Across all of these scenarios, raising prices would increase renewal revenue and decrease new-business revenue, and the renewal revenue increase would be larger than the new-business decrease such that Defector would see higher overall subscription revenue. Feeling assured that any price increase would grow revenue, we could confidently have the more qualitative debate about how large of a price increase we were comfortable taking and what tradeoffs to the business that implied.+ The original version of this annual report stated this number as 41k. As of August 2023, we have updated and reconciled our methodology for calculating past counts of net active subscribers and are restating this number such that year-over-year comparisons are accurate going forward.