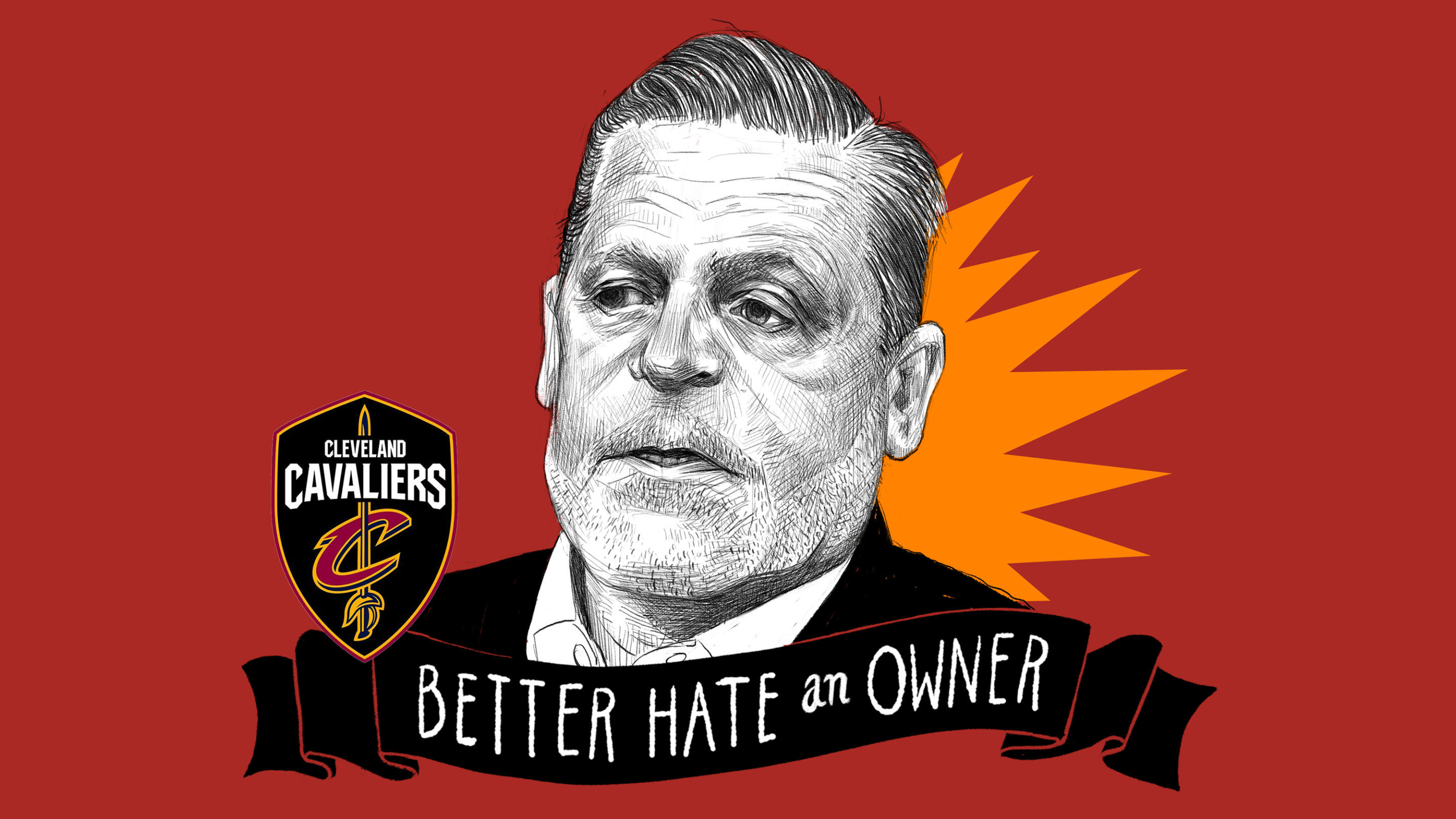

Welcome to Better Hate An Owner, a recurring feature in which we learn more about all those awful old people who get to hold the trophy first at championship ceremonies. Today’s entry is about Cleveland Cavaliers owner Dan Gilbert.

How much of his soul did he lose in making his money?

Dan Gilbert’s fortune comes from his success in the world of mortgages. He was raised by a pair of Century 21 real estate agents, went to Michigan State University—where he was arrested for running a sports gambling operation—and then co-founded Rock Financial while at Wayne State’s law school in 1985. The company essentially cut out the middlemen (real estate agents) from the process of getting a mortgage, and thanks to its early adoption of the internet, it became one of the leading mortgage-lenders in the country.

Oddly, Gilbert sold the company—now better known as Quicken Loans—for $532 million, then bought it back three years later for a mere $64 million. He currently serves as Quicken's chairman, and its success has allowed Gilbert to become involved with a multitude of other projects. Some of these are obvious, like casinos, sports, and private equity, but others are a bit more random, like his ownership of Dictionary.com, or Fathead, or his investment in the esports brand 100 Thieves.

Still, the bedrock of Gilbert’s wealth is mortgages, not traditionally seen as a particularly noble or ethically pure way to make your money. However, since the financial crisis of the late '00s, Quicken has tried to brand itself as a squeaky clean operator, though they have not been able to escape charges of predatory lending, which have been well-catalogued by the Detroit alt-weekly Metro Times.

The Deutsche Bank National Trust Co. accused Quicken of “fraud in the loan origination process” in a $1.2 billion lawsuit from 2014, saying that loans they bought were far riskier and less stable than Quicken represented them to be.

A lawsuit filed in 2015 by the Justice Department charged that Quicken cost the Federal Housing Administration millions of dollars by improperly underwriting loans that did not meet the FHA’s lending program’s requirements. That suit was settled for $32.5 million in 2019.

Quicken was found to have violated federal labor law in 2016 with several of its rules in an employee manual.

In 2017, Quicken Loans had an $11 million penalty imposed on them by a federal judge after a class action lawsuit said that the company illegally collaborated with supposedly independent home appraisers to increase the value of homes. The judge in that case said that Quicken’s chicanery was "truly egregious” and “jeopardizes the American dream of homeownership."

The crucial question that’s dogged Gilbert over the past decade is exactly how large a role he played in the subprime mortgage crisis, particularly in the Detroit area. A Detroit News investigation from 2015 found that Quicken had a better record than subprime companies like Ameriquest, but of the companies that did not collapse after the economic crisis hit, Quicken had the highest number of foreclosures in Detroit, with half of those properties becoming blighted by the time of the investigation. Using one method to determine whether or not a loan was subprime—three percentage points higher than comparable treasury rates—the News determined that from 2004 through 2006 (just before subprime lending all but disappeared), 24 percent of Quicken’s loans in Detroit were subprime.

Gilbert took issue with the News' definition of “subprime” and has maintained that Quicken never wrote or originated those kinds of mortgages. Still, a dive into Quicken’s legal history could easily lead one to conclude that, even if you mostly avoid the really bad behavior, it’s still impossible to be an enormous money-lender without selling your soul at least a little bit.

Is he a fail-child?

No. Gilbert seems to come from solidly middle-class beginnings, growing up in an entrepreneurial family with a grandfather who owned car washes and a distant father who owned some bars before he and Gilbert’s mother went into real estate.

However! His son AJ is a strong candidate for that designation. The University of Michigan undergrad went viral last year when MLive profiled him and his business partner, detailing how the two teens made $1 million in two years with “a customized promotional branding business for companies, events and organizations.”

"We started it from nothing,” AJ says in the article.

“We started with a strong presence in Detroit by landing Quicken Loans Family of Companies,” he goes on to say. The article adds that Quicken remains the company’s top client.

How much public financing has he sucked out of the community?

Hoo boy. Gilbert's big projects have helped make him the recipient of truly staggering amounts of public money and tax incentives. In 2018, he got incentives worth $618 million from Michigan for four developments in downtown Detroit (Gilbert claimed that the new and renovated buildings would create 24,000 jobs, though critics have argued that he'd just be moving jobs from one part of the state to another). He also got a valuable tax break from Trump's 2017 tax law, which designated three sections of downtown Detroit dominated by Gilbert as "opportunity zones," which are designed to incentivize new investment. One of those areas made the cut despite being one of a few across the country that did not actually meet the program's requirements.

As Gilbert has invested an estimated $3 billion into Detroit, Michigan lawmakers have gone out of their way to make building new developments easier and less expensive for the state's richest man. Perhaps most notable of these are the "Michigan thrive bills," which Gov. Rick Snyder signed into law in 2017. They not only gave Gilbert access to tax credits for his planned downtown skyscraper, but they also allow him to keep 50 percent of income taxes from jobs generated by these projects.

"The premise inherent in the idea of such tax incentives is that it's OK for developments to be zero-sum for the communities in which they're located: That it's OK if taxes generated by new development don't go into the coffers of the city in which the development is located," wrote the Detroit Free Press in an editorial criticizing these laws.

The Epstein Degree: How many degrees removed from Jeffrey Epstein is he?

Donald Trump. See below.

What are his political affiliations?

Though he’s publicly claimed to be apolitical and has donated large amounts of money to both Democrats and Republicans, Gilbert has an association with the Trump family. He drew attention back in 2017 when he happened to be visiting the President at the White House on the same day that the Chicago Cubs were making their trip. Trump made some benign jokes when Gilbert and the team crossed paths, asking if he wanted to get in a group photo and if he wanted a baseball player on the Cavs.

Trump called Gilbert a "great friend of mine. Big supporter and great guy."

Additionally, Quicken Loans contributed $750,000 to Trump’s inauguration, and Gilbert caused a minor stir when he appeared with Ivanka Trump at a Detroit event promoting STEM education.

"Our interests are in the policies at the federal level, and not the politics surrounding the elections," read a statement from Quicken attributed to Gilbert ahead of the Ivanka appearance. "We have often supported both political parties in the same election so that we have the ability to impact positive change, regardless of who occupies the offices."

A helpful way to understand Dan Gilbert, both as a sports owner and a businessman with a savior complex, is through the lens of the Detroit suburbs. While I was growing up in Livonia—the whitest city of its size at the time of the 2000 census—Detroit was an easy punchline. Its mayor, Kwame Kilpatrick, was a crook. The ill-fated People Mover was desolate. The New York Times called it "the World Capital of Staring at Abandoned Old Buildings."

Detroit was a place that white families from the suburbs didn't visit except to go to Tigers games in Corktown and Red Wings games in a concrete block on an undeveloped riverfront, and maybe the auto show once a year, or a concert at the Fox Theatre. Then the Tigers got a new ballpark right in the heart of downtown and the Lions moved right next door, and bars and restaurants popped up around them. At the same time, gentrification in Midtown created that area's own trendy spots. Slowly, the empty space between the two areas shrunk, until the opening of Little Caesars Arena—which was pitched as a new home for the Red Wings but also brought the Pistons and A-List concerts down from Auburn Hills—made it not only possible but downright enjoyable to get into a car, park in Foxtown, and bar hop for a dozen blocks through the Cass Corridor before, I don't know, seeing some indie band at the Majestic.

To do this without interacting with any of many businesses that Gilbert has had his hands in downtown—whether it's shops at the ground floor of his buildings or the beautiful public space right across from One Campus Martius or the Greektown Casino or the chic Shinola Hotel or even just one of his parking garages—would not be easy. Dan Gilbert is the corn syrup of Detroit: He's in everything whether you realize it or not. (Along with the Ilitch family, who owns the Wings and Tigers.)

That is, if you're coming from outside the city for a fun night out. For those on the margins of Detroit itself—one of the estimated 220,000 living in poverty in a city of about 670,000—the gains of cooler bars and bigger concerts downtown are not so strongly experienced. Another meaningful interaction with Gilbert's work might come in the jail and courthouse complex he's currently building for the county.

It is unarguably true that Detroit is in better condition now than it was when I was born in 1995. It is also true that the narrative of Gilbert gets absurdly hyperbolic when it focuses on the shiny playthings he's created for visitors over the basic necessities that many residents still lack. This glowing Forbes profile from 2014 perhaps best describes the suburban perception of Gilbert. In it, Detroit is referred to as "the most dilapidated, forlorn urban environment in North America" and "the poster city for all that's gone wrong in urban America," But, when talking about the areas where he has invested the most, the writer indirectly compares the billionaire to God himself.

Yet downtown things have changed, unmistakably. Detroit's reborn Campus Martius park is a bustling urban Eden where office workers relax by listening to live music, lunching at outdoor cafés or sinking their toes into a sandy beach that didn't exist two years ago. Come November the beach will be replaced by a skating rink. Just to the east is the Quicken Loans Sports Zone, where cubicle dwellers from nearby Gilbert-owned office towers break from work to play volleyball and basketball. Most of the traffic is foot traffic, except for a parade of bright white shuttle buses emblazoned with the words "Opportunity Detroit." Gilbert runs them, too. Locals refer to the city center as Gilbertville.

If nothing else it's annoying how low we're expected to bow before a man who has so benignly deigned to rake in massive profits from a put-upon city. And yet it's never enough: Gilbert is notorious for freaking out about negative press coverage and launching well-funded offensives that attempt to combat his bad PR. He did this when ProPublica reported on the tax breaks he received, creating an entire website to try and blast what he called an "absurd article" that was "rife with misguided, misleading and utterly baseless allegations parading as fact." And when the Detroit News reported on how Gilbert is permanently entwined with blight and foreclosure in the city, he lashed out at the reporters, calling them irresponsible and unprofessional. He simply cannot stand it when sufficient praise is not bestowed upon him.

To a sports fan, Gilbert remains best known for the Comic Sans temper tantrum he threw after LeBron James signed with the Miami Heat instead of returning to an empty shell of a Cavs roster. In an open letter to fans, the Cavs owner wrote that LeBron's decision was a "cowardly betrayal" and a "shocking act of disloyalty."

"Some people think they should go to heaven but NOT have to die to get there," Gilbert said of James, a free agent, signing with a new employer. This came just a few paragraphs after guaranteeing in all caps that the Cavaliers franchise would win an NBA championship before LeBron did. (It did not.)

This is how Dan Gilbert sees everyone that is not Dan Gilbert: They are either profitable to him, or they are disloyal.